Student Loans?

Carnegie Mellon is one of the most prestigious universities in America, especially in STEM related fields.

Student loan debt is the second highest consumer debt category in America, only trailing behind mortgage loan. It is more than both credit card and auto loans. As of 2018, the total amount of U.S. student loan debt reaches an all time high at $1.53 trillion spreading across 45 million Americans.

For the 2016-2017 school year, approximately 70 percent of four-year public and nonprofit private college students graduated with debt, and so did about 87 percent of students in for-profit private institutions. According to a 2014 research conducted by the New America Foundation, the average amount of undergraduate and graduate debt owed by a typical borrower was $40,209 in 2004 and $57,600 in 2012, which experienced a 43.3 percent increase.

“Student loan is something that is a major concern for college-age families and it’s just increased as tuition has increased over the years,” said CHS college counselor Mary Anne Modzelewski.

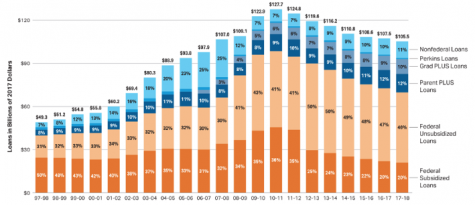

From 2010 to 2011, students and parents took $127.7 million of loan from federal and non-federal sources, the most ever provided in a single school year. That was more than a 200 percent increase than the 2000-2001 school year. Fortunately, since the 2010 to 2011 academic year, the amount of money borrowed has significantly declined, according to statistics provided by the College Board. The total loan taken out in 2018 decreased to $105.5 million, which was 17.4 percent less than the amount of loan taken out in the 2010 school year.

Statistics of the loans students took out over the last two decades.

With an average student loan interest rate of 10 percent, students may find it hard to pay off their debt after graduation. The standard repayment plan for federal student loans expects borrowers to pay off their debt in 10 or less years, but many take twice as long.

A 2013 study from the OneWisconsin Institute found that it takes graduates of Wisconsin universities 19.7 years to pay off a bachelor’s degree and 23 years to pay off a graduate degree. Furthermore, a 2016 research from Citizens Finance Group suggested that about 60 percent of the students expect to be paying off their debt in their 40’s.

Federal Reserve reported in 2016 that there are 6.8 million student loan borrowers from the age 40 to 49 that collectively owe $229.6 million. That means that Americans with student loan in their 40’s owe $33,675 on average.

Every year, an estimated $46 billion in grants and scholarship money is awarded by the US Department of of Education, which covered 34 percent of college costs in 2015-2016. In addition, about $3.3 billion in gift aid is awarded by private sources each year. Students rely on these scholarship to assist their college tuition.

“As College counselors, we absolutely address [the tuition cost] every year,” said Modzelewski. “We host a financial aid presentation in the fall, during which we invite the whole community to come to that, so it’s a presentation about how to apply for financial aid.”

Modzelewski warned that students should not take on an overwhelming amount of student loan because it might be very hard to pay off those debt once they are out of college and without a stable job.

“You can file for bankruptcy for personal property, but you can’t get out of a student loan,” said Modzelewski. “That debt follows you your entire life.”

As the costs of colleges increase every year, students are growing more concerned about their ability to afford tertiary education.

“I think it’s a major issue and that students should be very concerned the cost of undergraduate education increases every year,” said Modzelewski. “[High school students] should consider lobbying [their] legislators to fund higher ed and provide opportunities that Missourians can have their debt loan debt forgiven.”

Last fall, Maine started a program called the Educational Opportunity Tax Credit to deduct taxes for graduates who work in the state. This program allows workers to pay off their student debt from their state income tax liability. So if one owed $1000 in income taxes and they paid $900 for student loan, then they would only owe Maine $100. States do not need a federal law to start programs similar to Maine’s, the decision to relief student loan is left up to the state’s decision.

As college becomes more and more expensive, students are forced to take out more loans. The high tuition rate makes it especially hard for students from low income families to pursue in higher education. As the statistics show, these loans take a toll on students’ lives for more than 30 years, and this needs to change. As students, it is up to us to ask our government for help for our future.

Your donation will support the student journalists of Clayton High School. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

Yiyun is a sophomore at CHS and currently serves as the copy editor. She has previously served as a reporter. This is her second year on Globe. She is very excited to work with...